Every insurer possesses a goldmine of data, but few effectively leverage it. In an increasingly challenging and competitive insurance market, leveraging advanced data analytical capabilities is crucial for maintaining competitive advantage. According to a survey by Deloitte, 76% [1] of insurance executives consider data analytics essential for modernizing their core business.

Insurance companies that are first to extract insights from databases using data analytics tools will likely have a competitive advantage. It helps insurance companies make informed decisions by analyzing large amounts of information.

This blog explores the growing importance of data analytics in the insurance industry, the future trends, and use cases. It explores the key benefits, provides solutions to common implementation challenges, and outlines the stages of integrating insurance data analytics.

How Data Analytics Drives Growth for Insurance Companies

Data analytics significantly impacts the insurance industry, transforming how insurance companies operate and serve their customers. It allows insurers to base their decisions on comprehensive data analysis, leading to more accurate pricing and improved risk assessment.

This results in tailored insurance policies that cater to individual needs, faster claims processing, and enhanced customer service. Data analytics also empowers insurers to predict future trends and risks, reducing costs and making insurance more efficient and customer-centric. It’s a powerful tool that makes insurance companies more efficient, competitive, and innovative.

Future Trends in Insurance Analytics

Let’s explore key emerging trends signaling a significant transformation in how insurance companies aim to leverage data analytics:

Gen AI Gaining Traction

Generative AI is transforming how insurers interact with customers and assess risks. Today, GenAI and LLMs are being used to extract key information from policy documents to deliver concise summaries and automate claims analysis. It is used to power intelligent chatbots and generate personalized communications, leading to a significant increase in customer satisfaction.

Personalized User Experience

Advanced data analytics enables accurate individual risk profiles, which allows them to shift from a one-size-fits-all approach to offering highly personalized experiences. Predictive analytics in customer journey mapping allows insurance entities to anticipate insurance needs and provide proactive solutions even before issues arise. This enables insurers to use advanced segmentation techniques to personalize products and pricing by considering the behavioral data that serve them with unique products rather than standard packages. This might include offering usage-based insurance for occasional drivers or creating specific coverage packages for digital nomads.

AI and Predictive Analytics Take Center Stage

Advanced algorithms can now analyze vast amounts of structured and unstructured data to predict claim probabilities with better accuracy. What’s exciting is how these systems are getting better at detecting fraudulent claims while fast-tracking legitimate ones.

For instance, AI-powered image recognition can assess vehicle damage instantly, and natural language processing can review thousands of medical records in minutes. This means faster claim settlements for customers and more efficient operations for insurers.

Insurtech Revolution

In the last few years, we have already seen some emerging Insurtech companies changing how the insurance industry operates. They challenge traditional insurance models with the help of advanced analytics and innovative business operations. These companies are utilizing the latest technologies to process claims instantly, disrupting insurance prices with per-per-mile and other models according to the insurance types.

Insurtech uses data analytics to price policies and create new insurance products that traditional insurers never even considered.

Embedded Insurance

Imagine buying a new laptop, booking a vacation, and getting insurance at the checkout or integrated into your purchase – this is what embedded insurance is all about. Companies are utilizing data analytics and other innovative analytics tools to predict customer needs and provide them with relevant insurance products at the perfect moment. Embedded insurance uses real-time data analytics to price your insurance based on actual risk factors for specific purchases.

Blockchain Technology

Blockchain technology is revolutionizing the insurance industry to secure insurance operations and enhance transparency. It prevents fraud and streamlines processes like claims management through smart contracts—automated agreements that execute when certain conditions are met. Blockchain disruption is the next big thing that CIOs and global insurance leaders should focus on.

High-Impact Use Cases of Data Analytics in Insurance

Insurers are today using the power of data to identify new growth opportunities using customer information and, in a way, protecting their businesses from potential risks. The use of business analytics in insurance helps get insights about potential markets, competitors, customers, risks, regulations, and plans for natural disasters.

Listed below are some crucial analytics use cases in insurance that highlight how companies are leveraging this paradigm shift to achieve their business goals.

Pricing and Service Optimization

- The ability to examine risk and determine price policies becomes a central point of value creation for insurance companies. Data analytics in insurance sector helps actuaries to build policies better suited to dynamic business needs, market conditions, risk concentrations, and patterns.

- By analyzing consumers’ behavior, lifestyles, pricing sensitivity, and buying preferences, you can optimize and showcase more appropriate insurance products.

- Previously, it was difficult to customize policies at the individual level. However, insurance providers can now use pay-as-you-go and more dynamic pricing models based on clients’ behavioral signals, predicted risk factors, and shopping preferences.

Claim Automation

- Insurance data analytics enhances claims processing through automation, which results in enhanced efficiency and reduced costs. Through the help of predictive models, insurance companies can categorize claims according to priority, complexity, and potential costs. This helps segment high-cost and complex claims for further review by experts and enables automatic approval of simple claims.

Predictive Maintenance

- Predictive maintenance helps property insurers to identify maintenance needs and mitigate risks proactively. With the help of data analytics and IoT, insurers can analyze data and notify policyholders about necessary maintenance actions based on real-time conditions. For example, if sensors detect wear in machinery or vehicles, insurers can alert customers to perform maintenance, thus avoiding costly repairs or accidents.

Climate Risk Analytics

- By evaluating financial impact with the help of comprehensive risk assessment, insurers can identify climate-related physical and transition risks. With the help of advanced data modeling, they anticipate potential losses from natural disasters and regulatory changes.

- With the help of geographic information systems, insurers can conduct detailed risk assessments at a local level. This enables them to customize policy pricing and coverage options based on specific climate hazards and property characteristics, ensuring more accurate risk management. According to a report by Certus [2], most insurance companies widely use the TCFD framework for climate risk disclosure. The review report on climate risk management in the U.S. Insurance Sector revealed that 78% of the respondents disclosed information related to six or more of the 11 TCFD-recommended disclosures.

Fraudulent Claims Detection

- Improvements in technologies have made it possible to detect suspicious claims, fraudulent activities, and behavioral patterns by leveraging predictive analytics that are subjected to further investigation.

- Whenever a claim made by a user with a history of false claims is detected, the fraud prevention system halts the claim process and suggests case investigation. Predictive modeling techniques are applied to analyze patterns in fraud and screen false claims.

Risk Management

- Advanced data analytics helps conduct a real-time risk analysis that enables companies to become resilient in a volatile scenario to detect, analyze, and mitigate the situation and plan corrective action.

- Insurance data analytics provides the ability to integrate all your data from internal and external sources into one system to conduct comprehensive risk assessments. For instance, historical data can be collected from credit agencies, customer e-mails, user forums, third-party vendors, and social media.

- Previously, evaluating the risk of insurance policies was challenging because of the need to rely on specific, predefined guidelines, basic statistical models such as profiling and scoring models, and their intuitions. Data analytics in insurance sector help detect risky claims and forward them for further analysis.

Personalized Marketing Campaigns

- Use of analytics in insurance extract valuable insights from the vast database comprising details such as user’s demographic data, hobbies, lifestyle details, interests, belief systems, and more. This helps insurance providers devise targeted campaigns for their customers through personalized offers, policies, loyalty programs, and recommendations.

- The acquired data from various digital platforms helps create a hypothesis/model to craft personalization and marketing strategies. This leads to deciding on personalizing offers, policies, prices, and even marketing ads. A total of the same helps to acquire customers and, in turn, increases and supports the insurance rate ratio of a company.

Lifetime Value Prediction

- Customer lifetime value (CLV/CLTV) is one of the key stats that represent the profit generated by the business over the entire span of the relationship with your company. Insurance marketers can also get insights from CLV data to segment their existing user base and better understand the performance of marketing campaigns in real-time. Data analytics provides insights on revenues gained and expenses incurred predicted over the entire future relationship with a particular customer.

- Customer behavior data is used to forecast the CLV and predict the customer’s profitability for the insurance companies. This behavior-based model is utilized to forecast cross-buying and retention.

- CLV prediction provides the client with informative insights that enable forecasting the possibility of customer behavior and attitude, policy maintenance, or a policy surrender.

The above-discussed insurance analytics use cases help insurance leaders understand the implementation of emerging technologies and how they will help gain valuable insights and enhance decision-making.

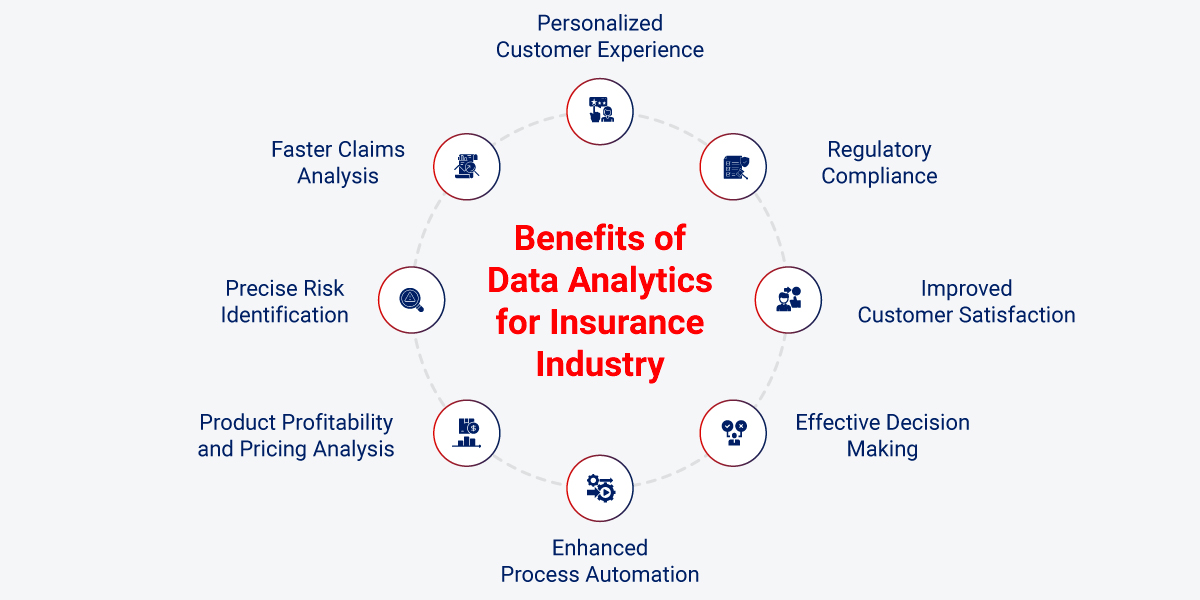

Key Benefits of Data Analytics for Insurance Industry

Visual representation brings insights to life for organizations managing high volumes of data. It collates information components across accident statistics and policyholders’ personal information and supports third-party sources to prioritize different risk categories, prevent fraud losses, and optimize expenses. This allows brokers and underwriters to make fast, informed decisions from their preferred location or device, speeding up decision-making overall.

Smart analytics solutions help organizations make decisions across various areas of their business. The key insurance data analytics benefits include:

Personalized Customer Experience

Insurers can predict customers’ needs, behavior, and preferences by utilizing innovative technologies such as data analytics and predictive analytics. This helps them provide tailored insurance services and products to their customers. It will also assist in understanding omnichannel engagement to get an overview of how customers interact with their brand across different touchpoints. Through this, insurance companies can provide a seamless experience and optimize the customer journey.

This could be easily understood through a real-life example of how Lemonade Insurance uses AI-powered chatbots like Jim [4] that can settle an insurance claim within two seconds using artificial intelligence and machine learning. Presently, AI Jim takes 98% of the company’s first notice of loss reports to make the process seamless, helping them gain better customer engagement and retention.

Faster Claims Analysis

Advanced analytics enables the logical connection between data and effective action. With the growing adoption of automation, policy changes, and increases in claims data, there is an enhanced need for advanced claim analytics. Analyzing historical claim data during the claim-handling process helps the insurer identify bottlenecks and results in streamlining the claim assessment process. This enables the insurer to process claims faster and build trust between the insurer and policyholders.

Precise Risk Identification

Insurers conduct customer information verification while assessing the risks. With apt data management techniques, one can create various risk classes, and customers are segmented into different classes based on their profiles. You can even upload social media information and criminal records if you have any. All this data can then be put on a solid data viz dashboard, giving you insights and precise identification of high, moderate, and lower risk profiles. With the help of advanced analytics, insurers can also identify unusual patterns of behavior that indicate fraudulent activity, which results in reducing fraudulent claims and saves your organization from financial losses.

For instance, AI-powered telematics and usage-based insurance (UBI) is redefining how insurers assess risk. Allstate Insurance offers its customers the Drivewise app [3], which leverages telematics technology to monitor and reward the safe driving habits of its customers. The app collects in-depth driving data, which plays a key role in determining potential savings on insurance premiums rather than relying on general factors like age or location.

Product Profitability and Pricing Analysis

It helps investigate individual insurance products at a deeper level by analyzing the product performance and profit by distribution channel, geographic region, customer segment, and other factors. Within a BI system, it can check the product’s premium update, lapsation, claims, and other related details in real-time.

With these innovative and advanced analytics, insurers can implement dynamic pricing models that adjust prices in real time based on external factors such as economic shifts, regulatory changes, or competitor pricing.

Enhanced Process Automation

Optimizes operational processes by automating data entry, compliance checks, and repetitive tasks. By leveraging technologies such as RPA, you can automate & improve back-office processes and customer-facing services. This helps improve resource management, reduce costs, and enhance customer service delivery.

Effective Decision Making

Data visualization tools provide insights to empower marketing by tracking sales and services, claims processing, underwriting, product development, and other aspects of an insurance business. Insurance companies can glean abundant valuable information by using different data visualization techniques.

Improved Customer Satisfaction

With data analytics, you can digitally capture prospective clients’ feedback, store it, and derive actionable insights into their buying behavior and lifestyle habits. Utilizing the data, you can plan better to provide them with a better experience.

Regulatory Compliance

The insurance industry must adhere to several regulatory policies and compliance requirements. Integrating data analytics in the insurance industry helps adhere to compliance efforts and maintain a comprehensive audit trail of transactions and processes, making it easier to comply with regulatory standards and pass audits. It also helps in assessing risk exposure across the organization.

Overcoming Challenges in Data Analytics Implementation

The insurance sector faces complex challenges affecting its operations and customer-centric approach. These challenges demand innovative strategies for sustainable growth and customer satisfaction. Let us understand these challenges in more detail.

#1 Challenge: Cost Escalation

The most critic al challenge for insurers revolves around the continuous rise in cost-of-living expenses. Rising inflation and healthcare expenditures further exert pressure on insurers to keep premiums affordable for customers and adjust premium rates accordingly.

The growing number of natural disasters and the increasing cybersecurity threats can lead to business disruptions and put pressure on insurance companies’ profitability.

Solutions

- Fraud Detection: Data analytics can be used to detect fraudulent claims. Machine learning algorithms analyze claims data for unusual patterns and anomalies to help predict when claims are likely to be fraudulent.

- Risk Assessment and Pricing: Data analytics enables insurers to conduct advanced risk assessments. Insurers can accurately assess risks by analyzing extensive data sets, including historical claims and external data sources.

- Claims Management: Automation and analysis of claims data help insurers identify trends and patterns that could lead to higher claim costs.

#2 Challenge: Potential Regulatory on Volatility

Health insurance companies operate within a highly regulated environment, encompassing federal, state, and local levels of regulation. This complex regulatory landscape can introduce uncertainty, posing challenges for health insurers in planning for the future. Changes in regulations can significantly impact their business operations.

Solutions

- Regulatory Monitoring: Data analytics enables insurance companies to track key metrics and closely monitor compliance with regulatory changes at all federal, state, and local levels.

- Predictive Analysis: Data analytics tools can predict regulatory trends and changes by analyzing historical data and policy shifts. This proactive approach allows insurers to anticipate forthcoming regulations, assess their potential impact, and prepare for compliance well in advance, reducing the element of surprise.

#3 Challenge: Evolving Customer Demands

Modern consumers seek insurance app development tailored to their unique needs and delivered conveniently. They are also becoming increasingly price-conscious, prompting insurers to develop innovative strategies to meet these evolving expectations effectively.

Solutions

- Personalized Offerings: Data analytics enables insurers to analyze customer data and preferences. With this insight, they can create personalized insurance offerings that cater to individual needs and preferences, aligning their products more closely with evolving customer demands.

- Pricing Optimization: Insurers can use data analytics to develop dynamic pricing models that respond to real-time market trends and customer behavior. This allows them to offer competitive pricing while meeting the price-conscious expectations of modern consumers.

#4 Challenge: Technological Disruption

The emergence of advanced technologies, particularly artificial intelligence (AI), Machine Learning (ML), and blockchain, presents opportunities and challenges for insurance firms. These technologies hold the potential to create innovative products, enhance operational efficiency, and reduce operating expenses. However, their adoption demands significant investments in technology integration and employee skills development.

Solution

- Technology Assessment: Data analytics analyzes current claim processing efficiency vis-à-vis that of competitors and the industry as a whole to identify emerging technologies like AI and blockchain that are most likely to benefit the insurance company to boost insurance operations.

#5 Challenge: Increased Competition

The insurance industry is noticing intensified competition, with traditional insurers facing formidable challenges from newcomers. These tech-savvy entrants leverage advanced technology to introduce inventive insurance solutions, posing a significant challenge to well-established industry players.

Solution

- Competitive Analysis: Get competitive business intelligence insights for the insurance sector by analyzing market data and the strategies of competitors, helping traditional insurers adapt and innovate.

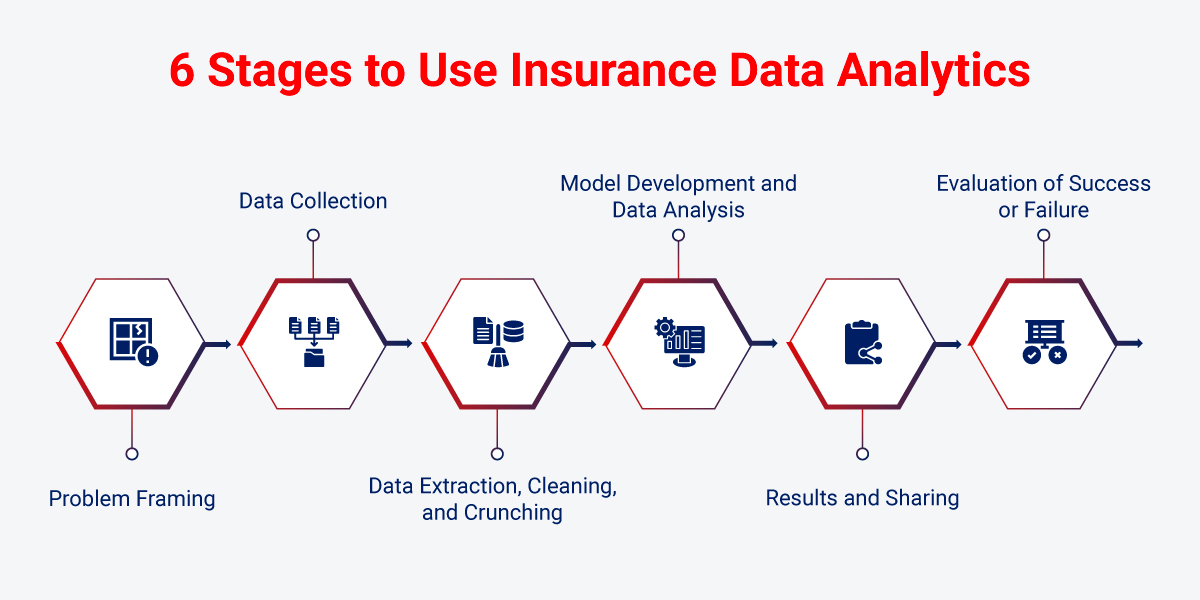

6 Stages to Use Insurance Data Analytics

To effectively integrate data analytics for insurance companies, it’s important to follow a structured approach. Let us break down the process into six main stages to help you understand it better:

1. Problem Framing

Before diving into data analysis, it’s essential to understand the problem you’re trying to solve. In this crucial stage, insurance companies identify specific challenges or questions they aim to address using data insights. These problems can range from optimizing premium pricing, identifying fraud, predicting customer churn, or streamlining claims processing. A well-defined problem serves as a foundation for the entire analytics process, guiding subsequent stages.

2. Data Collection

The next thing to do is gather the right information. Insurance companies have a wealth of data, like customer details and past claims. However, to get accurate results, it is important to ensure that the data is relevant and includes first-party and second-party data.

3. Data Extraction, Cleaning, and Crunching

Legacy systems often contain a wealth of valuable data that are still in use by the organization. Extracting, cleaning, and processing this data requires expertise and efficient analytics software. During this step, you’ll check for errors, eliminate duplicates, handle outliers, fill in missing data, and ensure the data is structured correctly.

4. Model Development and Data Analysis

Once your data is extracted, cleaned, and organized, it is time to analyze it thoroughly. There are four types of analyses:

- Descriptive analysis: This tells you what has happened in the past. For instance, an insurance company may summarize its customer base and claims data to identify trends and patterns in data.

- Diagnostic analysis: It helps you understand why something occurred. For instance, an insurance company might use diagnostic analytics to develop strategies to reduce customer churn.

- Predictive analysis: This predicts future trends based on past data. Insurance companies can use the data to develop and train predictive models, which are then used to predict customer behaviors, market trends, and risk factors.

- Prescriptive analytics: It provides recommendations for the future. Insurance companies can use prescriptive analytics to help customers manage risks or recommend actions to reduce the risk of fraud.

5. Results and Sharing

Insurance companies have a lot of stakeholders. Once the analysis is done, the results must be shared with many people. To ensure everyone understands the results, explain the information thoroughly with clear visualizations and precise explanations.

6. Evaluation of Success or Failure

Using insurance data analytics can be tricky. Even if it seems like it went well, figuring out why is essential. Did you notice any interesting patterns in the data that made you curious? Were there any issues with the data that needed extra care? This step helps ensure that what you did can be done again and made even better.

Why Choose Rishabh Software as Your Trusted Insurance Analytics Partner?

Rishabh Software leverages advanced data analytics tools and methodologies, empowering insurance companies to make data-driven decisions that optimize operations and maximize profitability. With a deep understanding of insurance dynamics, our team of expert professionals helps you build impeccable Data Analytics solutions.

Our full spectrum of data analytics consulting, implementation, and support services provide a one-stop solution to build a digital data ecosystem for your insurance business. Whether it be data engineering, BI & visualization, advanced analytics, AI/ML, data science, or managed analytics services, we help you craft visionary data strategies. Our unified and 360 data analytics capabilities will keep your organization at the forefront of digital innovation.

Frequently Asked Questions

Q – What is Insurance Analytics?

A – Insurance data analytics refers to gathering and examining information connected to insurance to uncover valuable and actionable insights. This process aids insurance companies in making more informed decisions. Subsequently, specialized statistical analysis software and insurance data analytics solutions are employed to analyze this data.

The primary objective is to identify recurring patterns and emerging trends within the data. This can then be utilized to determine pricing, evaluate risk, enhance operational efficiency, and identify instances of fraudulent activity within the insurance industry. It functions as a strategic tool that empowers insurance companies to operate with greater intelligence and efficiency.

Q: What is the Role of Predictive Analytics in Insurance?

A: Predictive analytics is crucial in the insurance industry, simplifying complex processes to benefit insurance providers and policyholders. In precise terms, it operates as follows:

- Assessing Risk: Predictive analytics helps insurers gauge the risk of insuring a person or asset. This information helps in setting appropriate insurance prices.

- Fraud Prevention: Predictive analytics is essential in identifying fraudulent activities. Analyzing patterns in insurance claims it flags unusual behavior and potential fraudsters. This safeguards financial resources and upholds fairness within the insurance system.

- Expedited Claims Processing: When policyholders file insurance claims, predictive analytics accelerates the process. It estimates the claim’s value and validates its legitimacy based on historical data, ensuring quicker and more accurate claim settlements.

- Tailored Insurance: Predictive analytics enables insurers to offer personalized insurance policies. They can customize coverage to align with individual needs.

- Strategic Planning: Insurance companies use predictive analytics for future planning. It assists in forecasting the expected number of claims in the upcoming year, aiding in financial preparations.

Q: How does the Traditional Insurance Process Differ from Insurance Analytics?

A: The traditional insurance industry has relied heavily on manual processing and legacy systems that are not well-suited to manage and analyze large volumes of data. As more insurance consumers move online and the volume of data increases exponentially, it becomes difficult to compete with insurance companies that are using the latest data analytics technologies.

On the other hand, insurance analytics utilize data and predictive analytics, AI/ML, data lakes, and big data analytics to offer a more individualized service. This modern approach automates a substantial portion of the calculation process, enhancing accuracy and reducing dependence on human input. Insurance data analytics software drives these automated calculations. As a result, the margin for error significantly diminishes, and insurance operations become more efficient.

So, while the traditional insurance process may have been the norm for many years, insurance data analytics is changing the game.

Q – How Can Small Insurance Companies Use Data Analytics Effectively?

A – Small insurance companies can utilize data analytics in the following ways:

- Risk Assessment: Use predictive analytics for accurate underwriting and pricing

- Fraud Detection: Implement ML algorithms to identify suspicious claims patterns

- Claims Processing: Automate routine claims for faster settlement

- Customer Insights: Analyze behavior data for targeted product offerings

- Operations: Optimize workflows and resource allocation through process analytics

- Market Analysis: Track trends and competitor data for strategic decisions

Footnotes:

1. https://www2.deloitte.com/us/en/insights/industry/financial-services/modernizing-l-and-a-systems.html

2. https://www.ceres.org/resources/reports/climate-risk-management-us-insurance-sector

3. https://www.carriermanagement.com/features/2024/05/23/262470.htm

4. https://www.allstatenewsroom.com/news/drivewise-25/