The focus on responsible investment and Environmental, Social, and Governance (ESG) reporting has significantly increased in the last few years. Investors now incorporate ESG performance and engagement into their long-term investment decisions and portfolio management strategies. This helps them recognize ESG considerations’ significant impact on investment outcomes and sustainability

Measuring ESG performance is challenging for fund managers because traditional data sources are often fragmented and time-consuming. Due to this, fund managers face many challenges in accessing accurate, credible, and consistent ESG data. The client wanted to empower fund managers with comprehensive ESG data and scoring capabilities.

Let’s explore how we partnered with a European fintech firm and helped them to develop an AI and SaaS-based ESG compliance platform.

Project Overview

A European Fintech organization was on the lookout for a reliable development partner to build an AI and SaaS-based ESG investment compliance application. The client’s goal was to support fund managers with a reliable platform to automate the end-to-end process of ESG data extraction, scoring, portfolio monitoring, analytics, and reporting. This application will support them in measuring sustainability performance and managing ESG risks more effectively.

As a trusted development partner, Rishabh Software helped the client develop an AI/ML-powered SaaS solution for ESG investment compliance using AWS lambda functions, implemented in Node.js to provide a robust and scalable platform for ESG reporting.

Challenges

- Primary POC lacked enterprise-grade features and scalability

- Manual data entry led fund managers to errors and inefficiencies, risking data integrity and revenue potential.

- Siloed and unstructured ESG data management across multiple systems restricted transparency and impacted data integrity.

- Non-adherence to ESG risks endangered financial stability, operations, and reputation.

Solution

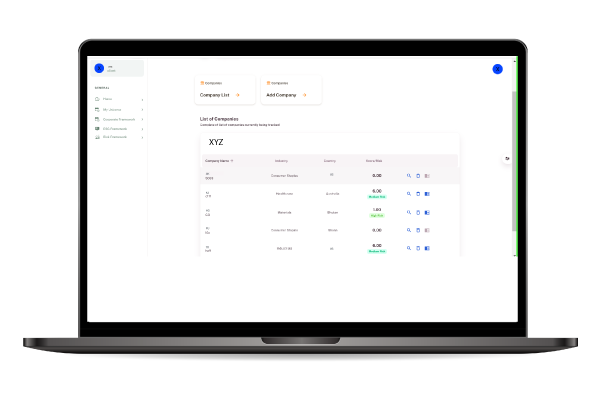

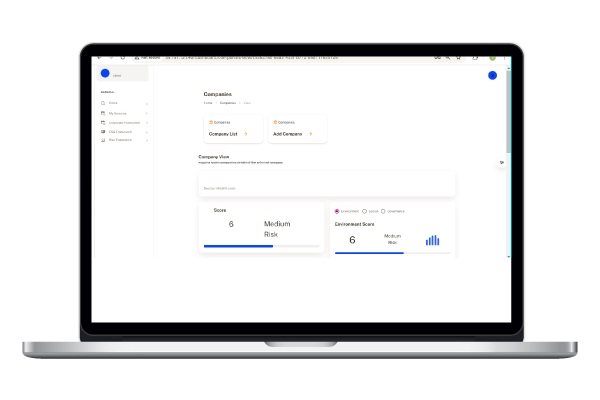

To address the above challenges, we developed a web application with advanced analytics and an intuitive UI featuring separate portals for administrators and clients. This feature-rich admin portal allowed the admin to efficiently manage the application, user accounts, and other tasks. Also, the client portal enabled fund managers to register and make informed decisions seamlessly with the help of ESG scores.

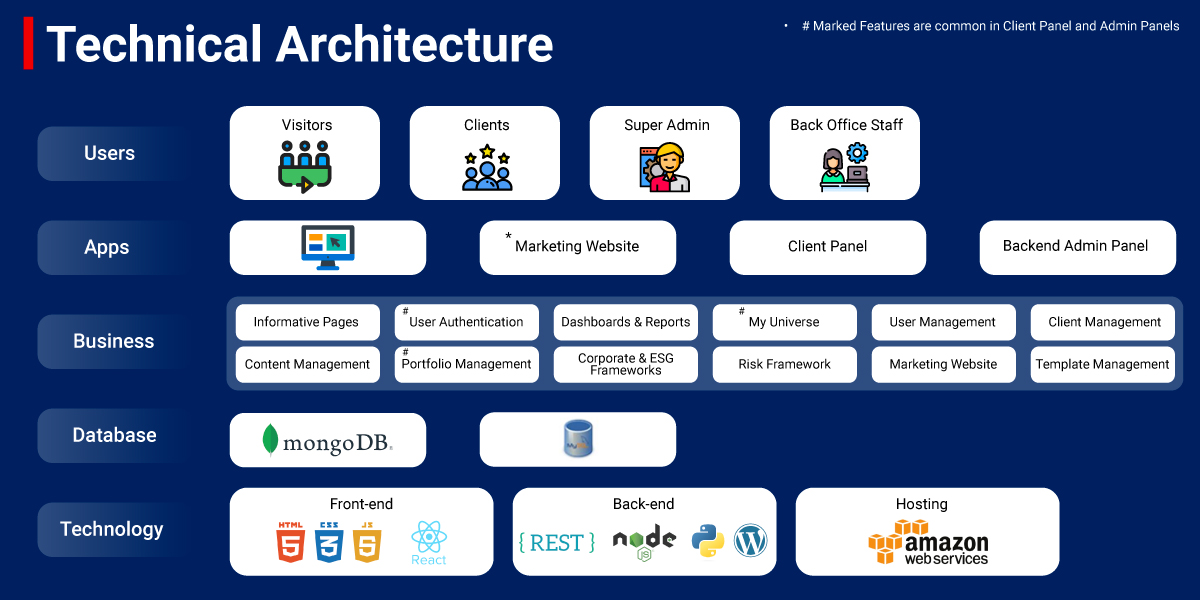

The AI and SaaS-based ESG investment compliance web application was built using a serverless architecture and a hybrid model, leveraging the following components:

Key Components of The Solution

Serverless Architecture

We used AWS Lambda functions in Node.js to develop the serverless application to handle requests and responses seamlessly. We leveraged DynamoDB to store and manage data. With our expertise, we reduced the need for server maintenance and improved scalability.

Automated ESG Score Calculation

We utilized a Python script in the solution that will automatically calculate ESG scores based on various factors. The automation reduced the manual effort required to calculate ESG scores and helped the end user generate the portfolio company’s ESG footprint in just a few steps.

Hybrid Development Model

Our expert team executed this project by combining the elements of cloud and on-premise development approaches. It helped the client leverage the benefits of both – the cloud for scalability and cost-effectiveness and the on-premise for more significant control over data security and customization. The hybrid model allowed our development team to build an efficient, scalable, and feature-rich investment compliance platform.

AI-driven Automation

We developed a POC to implement AI-driven automation within the developed portal and questionnaire. Our solution helped the client automate the investment compliance process for corporate ESG data.

The solution collectively formed a comprehensive and user-friendly application that enabled investment managers to access and utilize ESG data effectively. This investment compliance solution also helped reduce manual effort and improve scalability.

Benefits

- 85% improvement in fund manager’s satisfaction rates

- 80% reduction in manual efforts

- 70% ESG-related risks reduction

- 90% reduction in the complexity of ESG reporting

- 85% increase in overall operational efficiency

Customer Profile

A leading Europe-based FinTech organization that provides Investment compliance solutions.

30 Min

30 Min