The dynamic landscape of the banking sector is rapidly shifting from conventional methods to innovative, technology-driven approaches. Banks are increasingly eager to leverage powerful advancements like Generative AI to enhance operational efficiency and scale their services. This proactive adoption of technology is reshaping the very essence of banking, enabling new business models that transform customer interactions and elevate the overall experience. Generative AI-driven systems are revolutionizing conventional banking processes -from automating data extraction and interpretation to generating large-scale, insightful data for smarter decision-making. As banks embrace these intelligent GenAI systems, they are setting the stage for a new era of modern, responsive, and personalized banking.

The leap to Generative AI in banking is not merely about adoption but also gives banking institutions of all sizes with a path to building a responsive, personalized, and resilient banking ecosystem. According to McKinsey & Co., the global Generative AI market in banking and finance is expected to grow rapidly, reaching approximately $21.8 billion by 2034 [1].

So far, Generative AI and its capabilities in the banking sector were previously unimaginable; however, things are different now. In the pursuit of empowering your banking operations, keep reading this blog to explore aspects of GenAI in banking, such as top use cases, benefits, key implementation challenges, and their solutions.

Use Cases of Generative AI in Banking

From leveraging conversational AI in Banking to developing LLM for financial services, the applications of Generative AI in banking and finance is expanding fast.

The effective utilization of Generative AI enables outcome-driven operations, helping the industry drive innovation, improve operational efficiency, and enhance productivity. Here are the top applications of Generative AI in banking ecosystem, transforming operations across front, middle, and back offices:

Gen AI Use Cases for Front Office Operations

- Personalized Customer Onboarding: Generative AI in the onboarding process of new customers brings terms like hyper-personalized and seamless experiences that not only focus on engagement but also achieve retention goals. Generative AI for banking enables intelligent document recognition for critical documents like passports, utility bills, and ID cards by extracting data in automated mode and verifying it with advanced image analysis capabilities. For personalized onboarding, a Gen AI model trained on previously gathered data tailors communication channels and dynamically adjusts forms based on user input. Real-time verification utilizing facial recognition enables a highly secure onboarding process. Predictive analytics helps reduce drop-offs by customizing the journey to boost engagement and satisfaction.

- Loan and Product Recommendations: Generative AI in the banking industry is fast replacing the traditional one-size-fits-all approach with data-driven recommendations to match customers with loans or financial products. It intelligently evaluates a customer’s financial profile, spending patterns, credit behavior, and life stage indicators to offer tailored loans, low-interest personal loans, flexible mortgages, or auto loans optimized to their budget and financial goals. Generative AI combines the capabilities of predictive analytics with behavioral clustering to empower cross-selling or upselling of complementary products, including credit cards, insurance policies, and other investment portfolios, making recommendations more personal and timelier. Additionally, Generative AI for banks allows the generation of hyper-personalized communication and offers, supporting marketing and sales teams in addressing customer needs comprehensively.

- Virtual Assistance: Smart enterprise chatbots powered by NLP and large language models deliver enhanced human-like customer service and 24/7 support. These GenAI-powered chatbots and virtual solutions provide prompt assistance even for complex customer queries. They can efficiently handle multiple tasks – from drafting human-like responses, recommending suitable financial services and products, and adapting the tone and language to meet the needs of customers regardless of region or language. Automating routine inquiries allows banking representatives to focus their expertise on high-value interactions and more complex customer needs that require human intervention.

GenAI Use Cases for Middle Office Operations

- Automated Credit Scoring & Risk Assessment: Banks can use Generative AI, with integrated capabilities of ML algorithms and predictive modeling for accurate evaluation of credit risks, making creditworthiness evaluation and risk assessment smarter. By training the algorithms on historical data and analyzing multiple data points such as transaction history, income patterns, spending behavior, and external economic factors, banking institutions can generate more accurate and data-driven credit scores in a minimized timeframe. Risk assessment has often been overlooked in conventional methods, but Generative AI can not only address this through intelligent behavior analysis and real-time processing but also speed up the process and reduce manual efforts.

- Fraud Detection and Prevention: Generative AI can continuously analyze and mine vast volumes of synthetic data to become more accurate over time and constantly keep its fraud detection algorithm updated with emerging fraud patterns. It can monitor transactions in real-time, analyzing patterns and anomalies across millions of data points simultaneously, which eliminates the traditional bottlenecks of manual review processes, which are often prone to human errors. GenAI also allows banks to proactively detect unusual patterns and prevent fraud cases.

- Regulatory Compliance Reporting: The intersection of Generative AI and banking has had a major positive impact on regulatory compliance. From automating compliance monitoring to continuously overseeing transactions and operations, Gen AI serves as a virtual assistant to guide customers on the latest policies and regulations. Also, Gen AI makes the overall compliance reporting process more accurate and efficient by minimizing errors.

- Trade and Transaction Validation: With its advanced algorithms to review, refine, and confirm transactions, Generative AI plays an essential role in automating trade and transaction validation. It starts by ingesting data, analyzing patterns, and applying predictive models to detect anomalies in real-time, cross-referencing data with live market information.

GenAI Use Cases for Back Office Operation

- Automated Document Processing: Generative AI-powered automation is fast transforming back-office document processing by combining techniques like Optical Character Recognition (OCR), Natural Language Processing (NLP), and Intelligent Document Recognition (IDR) to automate the entire document lifecycle – from ingestion to classification and data extraction. Furthermore, OCR is also strengthened by transforming the unstructured data from documents into structured data. IDR makes quick classification amongst all documents based on their types.

- Loan Servicing and Management: Through infused predictive analytics and machine learning algorithms, the Generative AI model intelligently analyzes borrower data, repayment patterns, and financial behavior to proactively manage loan accounts. This close tracking of account details helps banking branches avoid hidden risks and likelihood of default. In routine tasks, such as generating monthly statements and sending automatic payment reminders, Generative AI in banking and finance creates a streamlined, data-driven process, making everything more organized and efficient than banking stakeholders could have imagined.

- Dynamic Contract Generation: Generative AI can streamline and automate the process of creating, reviewing, and updating contracts in real-time, which reduces the risk of errors or disputes. Based on predefined parameters like customer data, service terms, transaction details, and more, Generative AI can flawlessly generate customized contract templates. It makes real-time adjustments to clauses and maintains content to meet the latest industry standards and legal requirements simultaneously. As a result, it reduces manual work for the back office, minimizes errors, and brings accuracy to the table.

Having explored these Generative AI use cases in banking, let’s examine their key benefits for the industry.

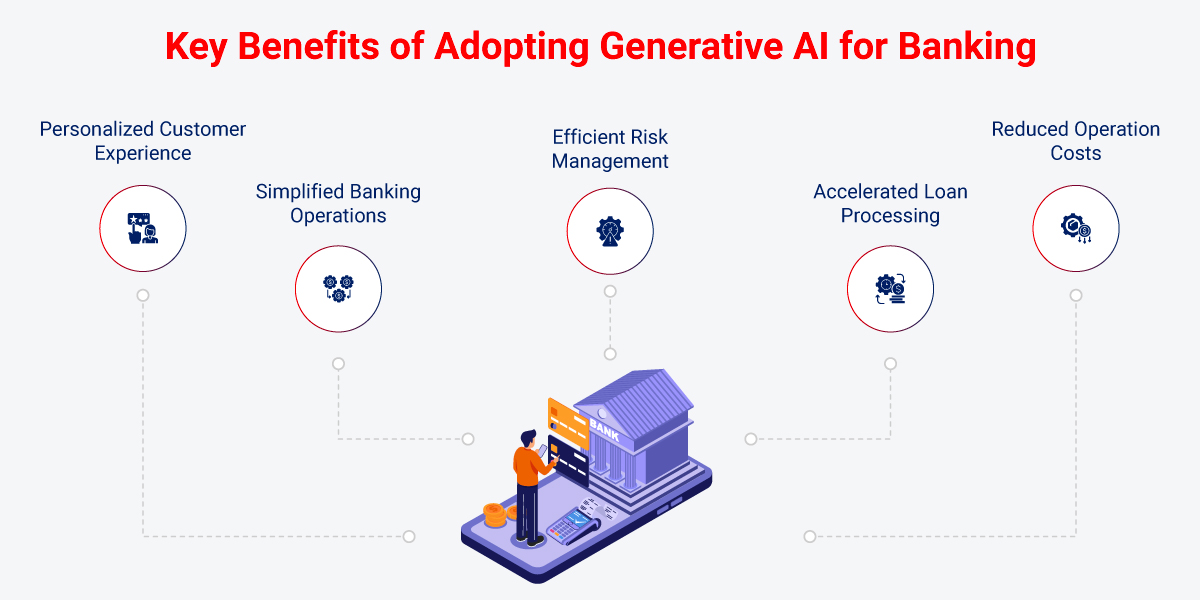

Key Benefits of Generative AI for Banking Industry

As AI technology matures, sophisticated GenAI solutions are pushing the boundaries of innovation and productivity across the banking landscape. Its integration streamlines key banking operations and automates traditionally manual tasks while efficiently transforming the entire spectrum of loan, debt, and document processes. This empowers banks to be more data-driven and achieve measurable results across their operations. Here are some key benefits of Generative AI in banking.

- Personalized Customer Experience: Gen AI in banking enables a hyper-personalized experience, providing customers with tailored, dynamic recommendations for products and new services. It allows marketing teams to strategically draft personalized messages that drive clicks and leads. With the role of a virtual assistant, Generative AI improves customer engagement through faster responses and helps gain customer loyalty toward banking operations and approaches.

- Simplified Banking Operations: Automating and enhancing routine manual tasks such as document processing, loan processing, data entry, and compliance checks, leveraging Generative AI for banking reduces associated risks and bottlenecks. This improves end-to-end operations with minimal manual workload.

- Efficient Risk Management: To maintain financial stability, Generative AI leverages its capabilities to analyze and evaluate various data sets, such as market trends, customer portfolios, operational data, and other macro-financial indicators, to make accurate risk assessments. This data empowers banks to gain insights into potential risks and take proactive actions on credit-related issues, fraud detection and prevention, and market volatility.

- Accelerated Loan Processing: One of the major benefits of Generative AI in the banking industry is its contribution to streamlining the credit approval and loan underwriting process by enabling swift, data-driven creditworthiness through advanced analytics. Through comprehensive evaluation of the spending pattern of the customer, and historical records, Gen AI makes the loan process more accurate and data-driven for banks.

- Reduced Operation Costs: The automation and optimization of various processes within the banking workflow ecosystem allow banks to reduce costs. Operations like document processing, transaction monitoring, and customer support now operate in automated modes, reducing the need for extensive human effort.

To better understand these transformative benefits, let’s examine how Generative AI surpasses traditional AI capabilities across key banking functions.

What Makes Generative AI More Effective Than Traditional AI in Banking Industry?

| Aspects | Traditional AI | Generative AI |

| Customer Interaction | Rule-based, scripted responses. Limited personalization. | Generates natural, personalized responses and conversations. |

| Fraud Detection | Relies on pre-defined patterns and anomaly detection. | Generates synthetic fraud scenarios to detect complex patterns. |

| Risk Management | Uses historical data to predict risks. | Simulates various financial scenarios for more nuanced risk predictions. |

| Document Processing | Limited to structured data and manual processing. | Processes and generates content from unstructured data (e.g., contracts, emails). |

| Compliance and Automation | Automates repetitive tasks with predefined rules. | Generates new content, such as summaries or translations, enhancing automation. |

Common Challenges in Implementing Gen AI in Banking and Solutions to Overcome Them

Maintaining Model Transparency and Explainability:

Banking regulators demand clear explanations for AI-driven decisions, especially in critical processes like loan approvals and compliance monitoring. Since Generative AI models operate through complex neural networks, their “black box” nature creates challenges for banks. This complexity presents significant challenges, such as transparency issues, making regulatory audits more difficult for stakeholders.

Solution: Banks can use model interpretability tools such as SHAP (SHapley Additive exPlanations) values or LIME (Local Interpretable Model-agnostic Explanations) to make Generative AI decisions more transparent.

Operational Scalability for High-Volume Tasks:

The banking industry involves managing daily extensive transactions and activities, such as processing loan applications and analyzing documents. Scaling Generative AI solutions for these high-demand processes can create hurdles due to the significant computing power required, which can be difficult to manage.

Solution: Leveraging cloud development services to create a more elastic cloud infrastructure allows banks to dynamically allocate resources as demand fluctuates within the banking ecosystem.

Interoperability with Legacy Banking Systems:

Many banks still rely entirely on legacy systems for day-to-day operations, which are not readily compatible with the adoption or integration of Generative AI-powered models or solutions. This leads to significant investments in APIs, middleware, and data-sharing protocols to effectively bridge the gap between old and new systems.

Solution: Prioritizing API-led and cloud-based solutions ensures the smooth transfer of data between Generative AI models and legacy systems. Banks can also focus on data orchestration layers and gradually modernize their infrastructure.

How Does Rishabh Software Help Build Generative AI Solutions for Banking Industry?

At Rishabh Software, we are a team of seasoned IT professionals with expertise across various technologies, platforms, and tech stacks, including AI development services. Our team is well-equipped to implement and scale Generative AI capabilities tailored to modern business needs and dynamic market demands. We specialize in seamlessly integrating AI-powered solutions, including Generative AI systems, into banking workflows. Our focus is on ensuring the safe and responsible use of Generative AI across the banking sector, helping institutions navigate complex challenges. By leveraging our expertise, we bring unprecedented opportunities to simplify operations, enhance efficiency, and stay ahead in the rapidly evolving financial landscape.

With over two decades of experience and having completed 1200+ projects for global clients and businesses, we are committed to fostering long-term growth for our valued clients. Our clear vision focuses allow us to maintain the highest standards of excellence in course client engagement, development, and delivery, ensuring consistent delivery of innovative solutions that drive success. We make continuous efforts to stay ahead of market trends, adapt to evolving technologies, and provide tailored strategies that align with our clients’ objectives, ultimately supporting their sustained growth and success.

Frequently Asked Questions

Q: What does Generative AI mean to banking?

A: Generative AI in banking is all about integrating this technology in various operations of front, middle, and back-end offices to enable automation, enhance decision-making approaches, personalize customer experience, and many more. It improves efficiency and accuracy and reduces manual workloads across various banking functions.

Q: How can small banks implement Generative AI effectively?

A: Small banks can start by adopting cloud-based AI solutions and collaborating with fintech startups for easier integration. Focusing on specific use cases like fraud detection or customer support can help achieve quick, impactful results.

Q: What does the future hold for Generative AI in the banking industry?

A: The future of Generative AI in banking promises increased automation, more intelligent decision-making, and enhanced customer engagement, leading to a more agile and data-driven financial ecosystem.

Q: Real-world examples of Gen AI in the banking sector

- OCBC Bank deployed a Generative AI chatbot, “Ask Emma,” to help its 30,000 employees automate tasks like writing investment reports and drafting customer responses.

- Airwallex introduced a Generative AI copilot to accelerate KYC assessments, reducing false-positive alerts by 50% and speeding up onboarding by 20%.

- Mastercard launched Decision Intelligence Pro – a Generative AI model to help banks detect suspicious transactions on its network.

Footnotes:

30 Min

30 Min