Get in Touch

You're just a message away from turning "what if" into "let's do it!"

Time zone

12:00 AM Next

12:30 AM Next

01:00 AM Next

01:30 AM Next

02:00 AM Next

02:30 AM Next

03:00 AM Next

03:30 AM Next

04:00 AM Next

04:30 AM Next

05:00 AM Next

05:30 AM Next

06:00 AM Next

06:30 AM Next

07:00 AM Next

07:30 AM Next

08:00 AM Next

08:30 AM Next

09:00 AM Next

09:30 AM Next

10:00 AM Next

10:30 AM Next

11:00 AM Next

11:30 AM Next

12:00 PM Next

12:30 PM Next

01:00 PM Next

01:30 PM Next

02:00 PM Next

02:30 PM Next

03:00 PM Next

03:30 PM Next

04:00 PM Next

04:30 PM Next

05:00 PM Next

05:30 PM Next

06:00 PM Next

06:30 PM Next

07:00 PM Next

07:30 PM Next

08:00 PM Next

08:30 PM Next

09:00 PM Next

09:30 PM Next

10:00 PM Next

10:30 PM Next

11:00 PM Next

11:30 PM Next

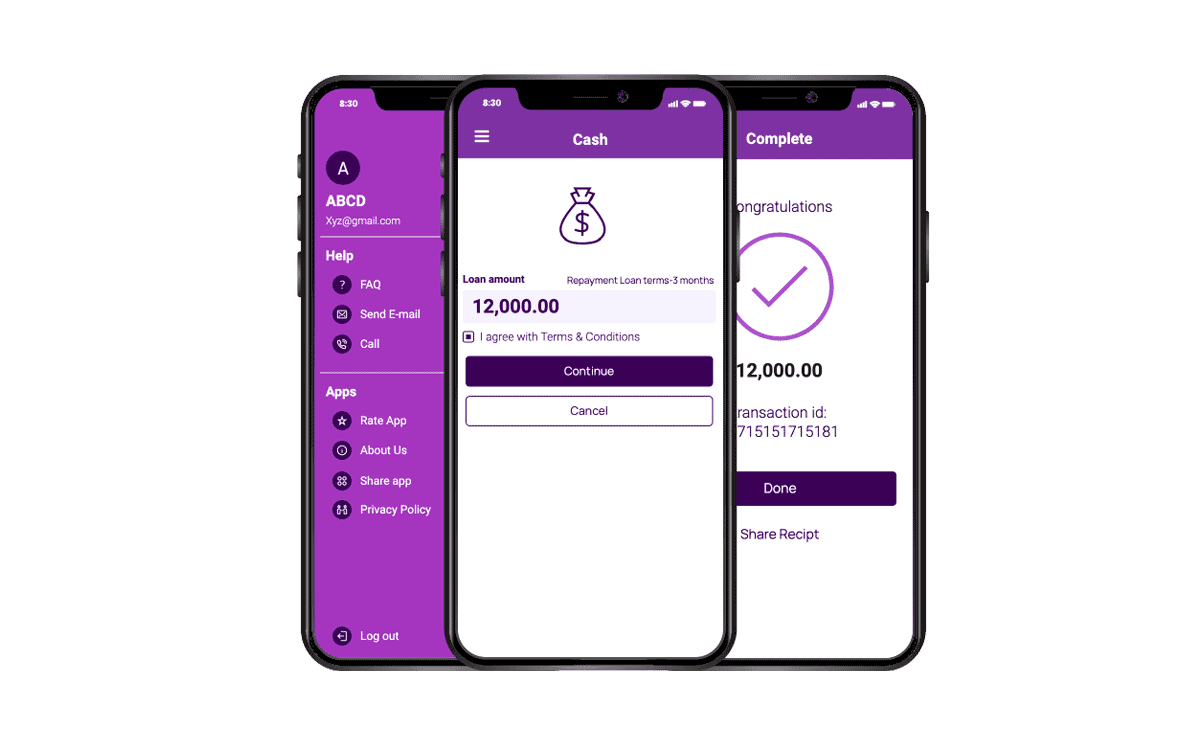

Review & Confirm

30 Min

30 Min

You are scheduled

A calender invitation has been send to your email.

30 Min Meeting

30 Min

30 Min